Early out self-pay is the process of contacting patients to resolve balances long before accounts become bad debt. It’s one component of a broader patient collections framework, which governs how patient responsibility moves, ages, and breaks down over time.

In theory, early out is straightforward: identify balances quickly, communicate clearly, and make it easy for patients to resolve what they owe. In practice, outcomes vary widely. Some hospitals see meaningful lift. Others put in the work and see little change.

Understanding early out starts with understanding how it is designed to work, and what assumptions that design depends on.

Why Early Out Matters

For hospitals with thin operating margins, proactive billing can have a significant impact. Early out self-pay programs aim to reduce the cost to collect, keep accounts from escalating into later-stage collections, and preserve patient trust by addressing balances while engagement is still high.

Early out is often positioned as a patient-friendly alternative to traditional collections; and when conditions are stable, it can be. However, early outreach alone does not guarantee recovery. Performance depends heavily on the accuracy, timing, and stability of the balances being worked.

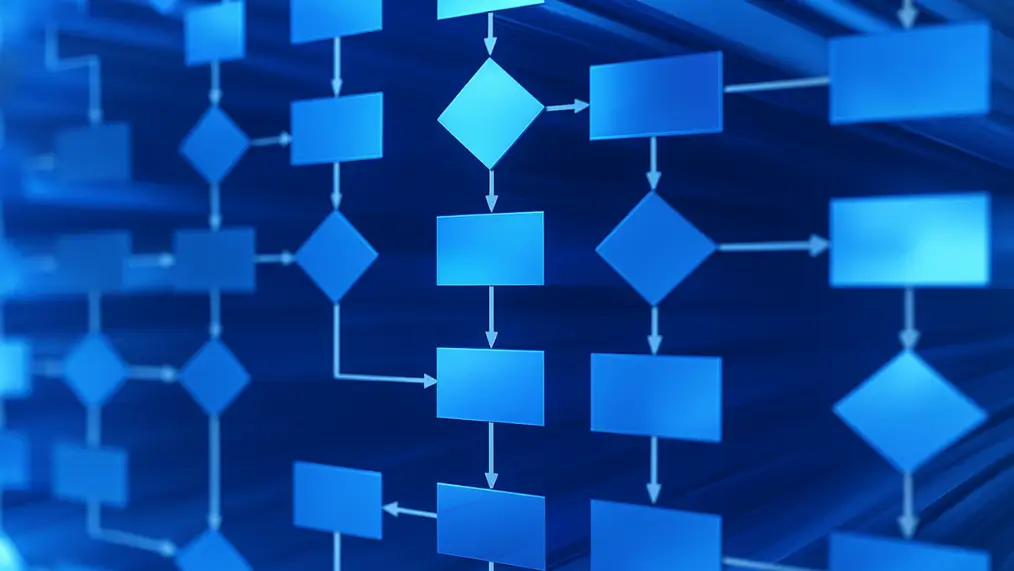

How Early Out Self-Pay Is Typically Implemented

The following steps reflect the intended operating model for early out programs.

1. Identify accounts early

Hospitals flag self-pay and post-insurance patient balances as soon as payments are applied. Accounts may be segmented by balance size, payer type, or expected likelihood of payment.

Pitfall to avoid: Waiting until after the first missed statement, when engagement often drops.

2. Develop a patient-friendly communication plan

Early out programs typically use a mix of calls, texts, emails, and mailed statements. Effective outreach explains charges clearly, references insurance activity, and highlights next steps.

Pitfall to avoid: Overly frequent or aggressive outreach, which can damage patient trust.

3. Offer flexible payment solutions

Online portals, payment plans, and financial assistance screening reduce friction and allow patients to resolve balances quickly, often in a single interaction.

Pitfall to avoid: Limiting payment options to inconvenient or outdated channels.

4. Leverage technology and automation

Automation supports consistency and scale, particularly for statements and reminders.

Most programs still require periodic human review to ensure tone, accuracy, and compliance.

Pitfall to avoid: Treating automation as a substitute for balance review or oversight.

5. Track performance metrics

Common metrics include recovery rate, days to payment, and patient satisfaction indicators.

Early out metrics are most useful when viewed alongside broader revenue cycle outcomes, such as bad debt write-offs and total self-pay cash.

Pitfall to avoid: Evaluating early out in isolation, without examining upstream drivers of balance quality.

Example Early Out Workflow

This simplified timeline illustrates how early out is intended to operate under stable conditions:

Day 0: Insurance posts payment; self-pay balance identified.

Day 3–5: First patient-friendly statement sent with clear breakdown of charges.

Day 10–15: Text or email reminder with payment link and options.

Day 20–25: Live call from patient services if no response.

Day 30–45: Offer payment plan or financial assistance screening if needed.

Day 60+: Final reminder before account moves to later-stage collections.

In real-world environments, balances may change, reverse, or remain unresolved for reasons unrelated to patient willingness to pay.

Early Out vs. Bad Debt Collections

Early out differs from bad debt recovery in both timing and tone. Bad debt collections typically begin after accounts age beyond 90 days and may involve third-party agencies. Early out focuses on resolving balances while patients are still engaged in the billing cycle.

Because of that timing, early out outcomes are often shaped before outreach begins, based on how patient responsibility is determined and communicated.

Integrating Early Out Into Your RCM Strategy

Early out is most effective when it operates within a broader patient collections and revenue cycle strategy. Outreach works best when balances are stable, explanations are clear, and payer activity has fully settled.

For a deeper look at why early out performance varies, and what affects recoverability before patient contact, see Patient Collections Today: What’s Changed and What Works.

Once those conditions are in place, Strategic Early Out Collections outlines program design, compliance considerations, and execution best practices.

Should You Manage Early Out In-House or Partner Externally?

Some hospitals successfully manage early out internally, particularly when staffing, technology, and recovery rates are strong.

Others struggle with inconsistent outreach, aging balances, or staff capacity constraints. In those cases, partnering with an early out service can provide dedicated resources, refined workflows, and additional oversight without adding permanent headcount. If early out feels busy but ineffective, the issue is often one of structure.

FAQ on Early Out Self-Pay

Q: How is early out medical billing different from standard billing?

A: Early out begins sooner and uses more active outreach. Standard billing often relies on passive statements before escalation.

Q: Is early out only for self-pay patients?

A: No. Many hospitals apply early out strategies to insured patients with post-insurance balances.

Q: What’s a good recovery rate for early out programs?

A: Rates vary widely. Programs with accurate balances, clear communication, and flexible options tend to outperform those working unstable or changing patient responsibility.

Q: When should an account be moved from early out to bad debt collections?

A: Most hospitals use a 60–120 day window, depending on policy, balance size, and response patterns.

Q: How do we ensure outsourced early out is compliant?

A: Look for early out vendors with HIPAA compliance certifications, documented training programs, and clear policies around patient communication. They should understand the distinction between early out and debt collection, and follow both healthcare privacy rules and consumer protection laws.

Q: Does early out affect patient satisfaction?

A: When balances are clear and outreach is empathetic, early out can reduce confusion and escalation. When balances change after outreach begins, satisfaction often suffers.