What Is a Collectible Patient Balance?

Most RCM teams treat patient balances as collectible by default; if it’s labeled patient pay, it goes into the workflow.

But the problem is, a lot of those balances were never truly collectible to begin with.

When patient collections underperform, the diagnosis is usually focused on scripts, staffing, cadence, early-out timing, or vendors. The assumption underneath all of it—that the balances being worked were valid, recoverable patient responsibility in the first place—is rarely questioned.

In reality, however, that assumption is where a significant amount of revenue quietly breaks down.

A collectible patient balance is not simply any balance labeled “patient pay.” It is a balance that survives a series of accuracy, timing, and accountability tests that most revenue cycles do not explicitly apply.

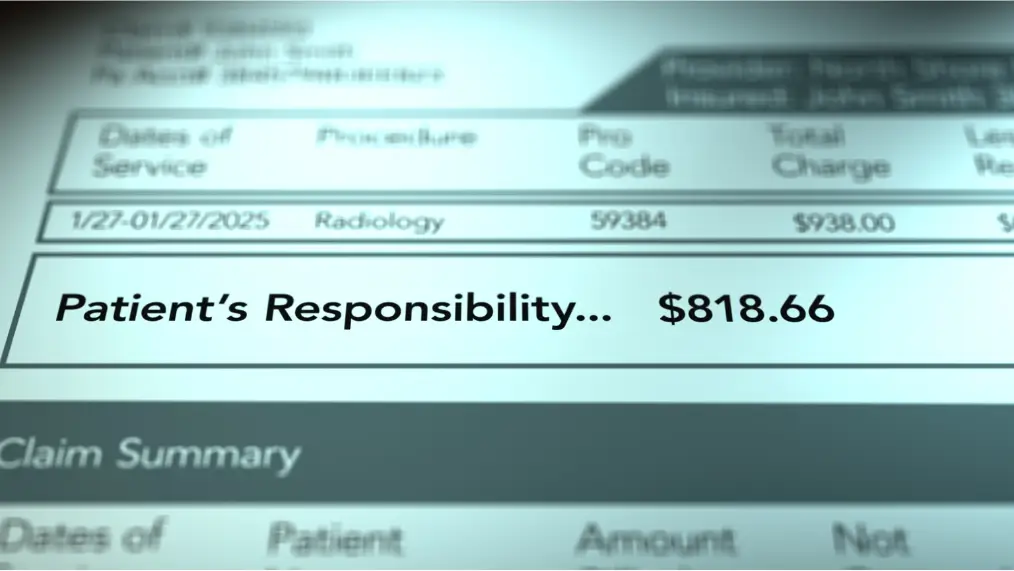

The First Broken Assumption: Patient Pay Equals Patient Responsibility

Most revenue cycle systems treat patient pay as a final state. Once a claim adjudicates and posts a balance to the patient, downstream workflows accept that designation as fact.

But system labels reflect process outcomes, not financial truth.

Balances are routinely shifted to patient responsibility because of:

- Eligibility drift after the date of service

- Missed or misrouted secondary billing

- Incorrect deductible or coinsurance application

- Authorization failures that are later overturned

- Coverage reversals or retroactive enrollments

In each case, the system resolves ambiguity by assigning responsibility to the patient, even when that responsibility is incomplete, incorrect, or temporary.

In short, the balance looks collectible when it often isn’t.

The Second Broken Assumption: Age Determines Collectibility

Patient collections strategies are still heavily governed by aging logic. Accounts move from statement to early-out to bad debt based largely on time.

Teams are used to thinking of collectibility as a timing problem; as balances age, they’re assumed to get harder to recover.

What actually kills collectibility is confusion. A balance becomes harder to collect when:

- The amount changes after billing

- The patient receives conflicting messages

- A payer issue surfaces late, then disappears

- A bill is sent before coverage questions are resolved

In these situations, the problem isn’t so much that the balance is old. It’s that no one is confident the balance is right. What was potentially recoverable early becomes uncollectible because trust and understanding collapse.

Ultimately, age alone is a poor proxy for collectibility.

The Third Broken Assumption: Low Yield Means Weak Collections

When recovery rates are low, the instinctive response is to push harder, perhaps calling for more touches, more calls, tighter scripting, or vendor escalation.

However, if a large portion of the accounts being worked were never truly collectible, yield will always disappoint. Staff time is consumed by disputes, reversals, complaints, and dead ends. Meanwhile, legitimately collectible balances are delayed or diluted by noise.

In this context, “underperformance” is a sorting failure, as opposed to a straightforward collections failure.

What A Collectible Patient Balance Actually Is

Once you strip away those assumptions, a collectible patient balance becomes easier to define.

A balance is generally collectible when all of the following are true:

- The balance is accurate

Insurance adjudication is correct, contractual adjustments are applied properly, and no additional payer should have been billed. - The patient is correctly identified as responsible

Eligibility, coordination of benefits, and benefit tiering were correct and stable. - The balance is communicated clearly and promptly

The patient received timely, consistent billing that reflects a final amount (not an easy-to-ignore placeholder). - The patient has a reasonable ability to pay

Income considerations, financial assistance eligibility, payment options, and prior behavior have been accounted for.

When any of these fail, collectibility drops. Operationally, collections outcomes are often constrained before billing even begins, because balances that enter patient outreach without stable adjudication, clear responsibility, and timing alignment seldom recover their original yield downstream.

Collectibility Is Not A One-Time Decision

Collectibility is dynamic.

A balance that appears collectible immediately after adjudication may not be once a secondary fails to fire. A balance that looks uncollectible may become recoverable once a payer issue is corrected.

The key point is that collectibility changes at predictable moments: When coverage shifts, when payer files update, when remits post, and when patient communication breaks down.

That’s why it’s important to reassess collectibility continuously, distinguishing between:

- Valid patient responsibility

- Correctable payer responsibility

- Truly non-recoverable balances

Each category demands a different workflow, whether that means fixing payer errors, validating patient responsibility, or formally closing accounts that are truly unrecoverable.

How Collectibility Breakdowns Show Up in Your Data

When collectibility is being misjudged, the signals don’t typically appear as a single metric failure. They show up as operational patterns across patient, payer, and workflow data.

Common indicators include patterns such as:

- High patient call volume tied to balance disputes rather than payment questions

- Frequent balance reversals after patient outreach has already begun

- A large percentage of patient-pay accounts later reclassified to insurance responsibility

- Early-out placements with consistently low yield but high staff touch time

- Patient balances aging despite repeated contact attempts and payment plan offers

- Disproportionate write-offs concentrated in specific payers, service lines, or time periods

When these issues appear together, they’re a sign that collectibility is being misjudged long before patient outreach begins.

What Actually Makes Patient Pay Collectible

Once collectibility is understood as something that can change over time—not a label applied once—the fixes become straightforward.

They are not about working accounts harder. They are about deciding, clearly and early, which balances are actually ready to be worked.

Someone has to own the decision that a balance is ready

In many teams, no one explicitly decides when a balance is truly finished on the insurance side. Adjudication slows, a balance posts to patient responsibility, and the account moves forward by default.

At that point, collections inherits the uncertainty.

What’s missing is ownership of the readiness decision. Someone upstream has to be accountable for saying, “Yes, insurance responsibility is settled here,” or, “No, this still needs work before it goes to the patient.” Without that call being made intentionally, collections teams start on the back foot, and without the authority to fix what’s unresolved.

When readiness is owned, several things happen immediately:

- Accounts stop drifting into patient outreach prematurely

- Rework and reversals surface earlier, before patient contact

- Failures become traceable to handoffs instead of showing up months later as write-offs

Collections shifts from trying to resolve ambiguity to working balances that are actually finished.

KPIs must match what collections teams can control

Most self-pay performance measurement focuses on lagging outcomes: dollars collected, days to collect, volume worked, write-offs. Those metrics all evaluate what happened after a balance was handed off.

The incentive they create is simple: Move accounts forward, even when responsibility isn’t stable.

A more useful signal is whether the balance stayed stable once patient outreach began. How often did responsibility change after statements were sent? How frequently did accounts cycle back to insurance follow-up? How much staff time was spent unwinding issues that existed before collections ever touched the account?

These are all signals that collectibility was misjudged upstream.

When KPIs reflect that reality, accountability shifts to the point where collectibility is actually determined. Collections performance becomes easier to interpret because it’s no longer distorted by unfinished insurance work.

Where this leaves collections

When readiness is owned and misjudged balances are identified earlier, patient conversations are clearer. Early-out placement becomes more predictable. Write-offs start pointing to system gaps instead of individual teams. Collections outcomes stop feeling random because the inputs are finally stable.

Patient pay becomes collectible not because of better scripts or more touches, but because the balance was truly ready when it reached the patient.

One Thing to Look At Right Now

If you want to pressure-test collectibility without changing any workflows, look at a small slice of recent patient-pay accounts and ask one question:

How many of these balances changed after patient outreach began?

That includes:

- Rebilling to insurance

- Secondary coverage firing late

- Balance reductions or reversals

- Write-offs tied to coverage clarification

Don’t worry about creating a perfect report; even a handful of examples is enough.

If balances are frequently shifting after statements, calls, or early-out placement, it signals a collectibility issue surfacing too late in the process.

Why This Matters Now

Patient responsibility is no longer a rounding error. As deductibles rise and margins tighten, patient balances account for a growing share of net revenue—and a growing share of avoidable waste.

When collectibility is assumed instead of validated, patient collections teams spend their time resolving confusion, reworking errors, and chasing balances that were never truly recoverable. The cost shows up as low yield, frustrated patients, and inflated write-offs.

When collectibility is treated as a decision—one that’s tested, revisited, and acted on early—patient collections stops being reactive. Recovery becomes more predictable, patient trust is easier to preserve, and teams spend their effort where it actually matters.

This explainer is one piece of a broader shift in patient collections. For a deeper look at how these issues connect across early-out, self-pay, eligibility, and bad debt, see what’s changed in patient collections, and what those changes mean for recovery.